Takaful

Personal Takaful Solutions

- Buildings

- Household Contents

- All Risks

- Motor

- Personal Liability

Commercial Takaful Solutions

- Property

- Motor & Fleet Vehicles

- Electronic Equipment and All Risks

- Public Liability

- Goods in Transit

- Fidelity Guarantee

- Personal & Group Personal Accident Cover

- Business Interruption

- Accounts Receivable, Theft & Money

Bryte Assist Services

- Roadside Assistance

- Emergency Home & Business Assistance

- Medical Assist and Trauma Helpline

At Albaraka Financial Services, our dedicated Takaful support team is available to assist you throughout the claims process — from notification to settlement.

We are committed to delivering a seamless, transparent, and ethical experience, supported by accredited service providers who ensure efficient claims handling and turnaround times.

Our 24/7 helpline ensures that help is always just a call away, providing guidance, claim status updates, and reassurance when you need it most.

Your contribution is risk-based and competitively priced — you don’t pay more for Shariah-compliant cover. In fact, Takaful is designed to give you peace of mind at a fair cost.

With Takaful, your contributions go into a shared pool that supports all participants in times of need. This means your money not only protects you, but also helps others in the community when unexpected events occur.

Importantly, the contribution belongs to the policyholders. If, after claims and expenses, there is a surplus in the pool, it may be shared back with participants — unlike conventional insurance where profits stay with the insurer.

Getting covered with Takaful is quick, simple, and obligation-free. At Albaraka Financial Services, we pride ourselves on customer service that goes beyond expectations — guiding you every step of the way.

✔ No obligation quote – explore your options without any pressure.

✔ Fast and simple process – our team handles the details so you don’t have to.

✔ Trusted service – Albaraka is known for excellence, transparency, and care.

✔ Shariah-compliant peace of mind – cover what matters, the right way.

Start today — let us help you secure a Shariah-compliant cover tailored to your needs.

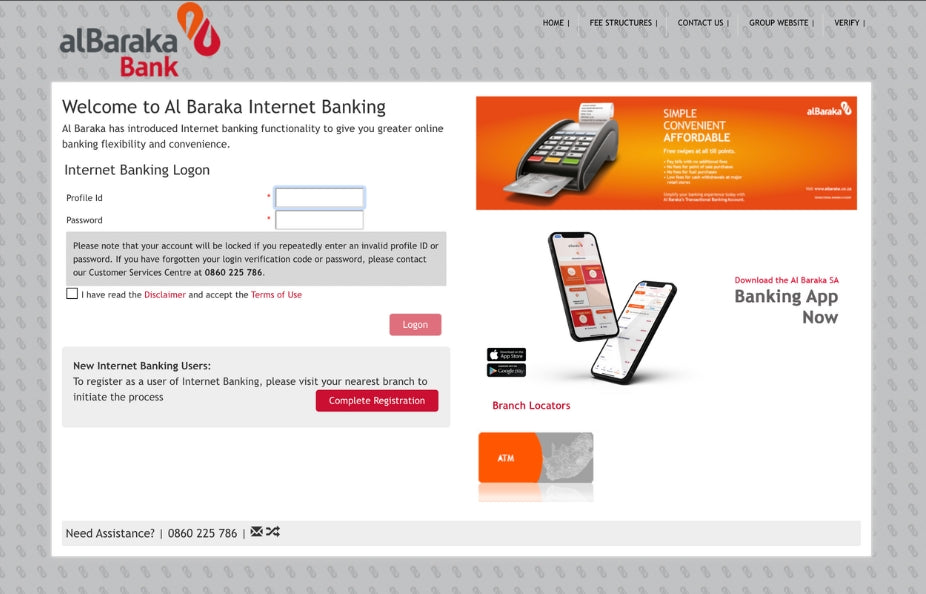

Contact us on

Customer Service: 0860225786

WhatsApp: 084 786 6563

Email us: customerservices@albaraka.co.za

To schedule an appointment

Q: How is Takaful different from conventional insurance and is it shariah-compliant?

A: Takaful is built on mutual co-operation and shared responsibility. Contributions go into a pool owned by participants, not the insurer. The rules are transparent, risks are clearly defined, and contracts are structured in a shariah compliant manner overseen by an independent Shariah advisory board.

Q: Is Takaful right for me?

A: Takaful is open to anyone who values ethical and transparent financial protection — Muslim or non-Muslim.

Q: What happens with surplus funds?

A: If there is a surplus after claims and expenses, it may be distributed among participants, donated to charity, or retained within the fund — unlike conventional insurance where the surplus remains with the insurer.

Q: Is Takaful more expensive than conventional insurance?

A: No, Takaful pricing is based on your individual risk profile.

Q: Is All Insurance Haram & Prohibited In Islam?

A: No, because no human action changes the will of Allah (SWT) or our destiny. Whether a person participates in a Takaful Fund or not has no effect on future events. However, we are urged to take precautions just as we make provisions prior to starting our journey.

In a Hadith narrated by Anas bin Malik when an Arab Bedouin asked the Prophet Muhammed (PBUH), "Shall I leave my camel untied and seek Allah's protection on it, or should I tie it?" The Holy Prophet (PBUH) replied, " Tie your camel and then depend upon Allah (swt)." [as quoted by Jami` at-Tirmidhi, 2517]

Our Takaful cover is built on the principles of fairness, transparency, and mutual care. Instead of paying into a system that earns interest, your contributions go into a shared pool that helps protect all participants in times of need. Any surplus is either shared, reinvested for the benefit of the group, or given to charity.

To give you complete confidence, every product is reviewed and approved by an independent Shariah Advisory Board. This means your cover is fully aligned with Islamic values while still giving you the protection and service you deserve.

With Takaful, you can be assured that you are safeguarding your family and assets in a way that is both ethical and Shariah-compliant.

Click here to view the latest Shariah Certificate

Get in touch

Please complete the form below and a member of our team will contact you as soon as possible: