BUSINESS OWNERS BEWARE! YOUR DEATH COULD RESULT IN THE CLOSURE OF YOUR BUSINESS

by Eleanore Hiralall: Attorney/Legal Services Division

The death of a sole member or sole director on a business can have serious consequences for the continuity and viability of the business. Depending on the type and structure of the business, different legal and practical issues may arise that need to be addressed by the surviving stakeholders, such as the executor, the heirs, the creditors, the employees, and the customers of the business.

The death of a sole director of a company

A company can have one or more directors, who are responsible for managing the affairs of the company. A director can also be a shareholder, who is an owner of the company. A shareholder can appoint or remove a director by passing a resolution at a shareholders' meeting. A director can also resign or be disqualified from being a director for various reasons.

Many businesses today are, by default or design, mostly sole shareholders and sole directors of these companies. Decision making in respect of these companies is centralised in one person who is a sole shareholder and a sole director.

However, this also poses a risk for the business continuity if the sole shareholder and sole director dies. According to section 71(3)(a) of the Companies Act, a person ceases to be a director when they die. This means that once a sole director dies, the company becomes incapacitated until a replacement director is appointed.

The problem increases, if the sole director is also the sole shareholder, there may be no one who can immediately appoint a replacement director, since directors are generally appointed by shareholders.

This problem can also be compounded by the delays in the administration of the deceased's estate. According to section 13(1) of the Administration of Estates Act 66 of 1965 (the Administration of Estates Act), when a person dies, their estate must be reported to the Master of the High Court (the Master) within 14 days. The Master then appoints an executor to administer and distribute the estate according to the will of the deceased or according to the law of intestate succession if there is no will.

However, this process can take several months or even years, depending on various factors such as the complexity and value of the estate, the number and location of beneficiaries and creditors, and any disputes or challenges that may arise. During this time, the executor may not have access to or control over the shares or assets of the company owned by the deceased. This can have negative effects on the business operations, such as:

- The inability to make decisions or enter into contracts on behalf of the company;

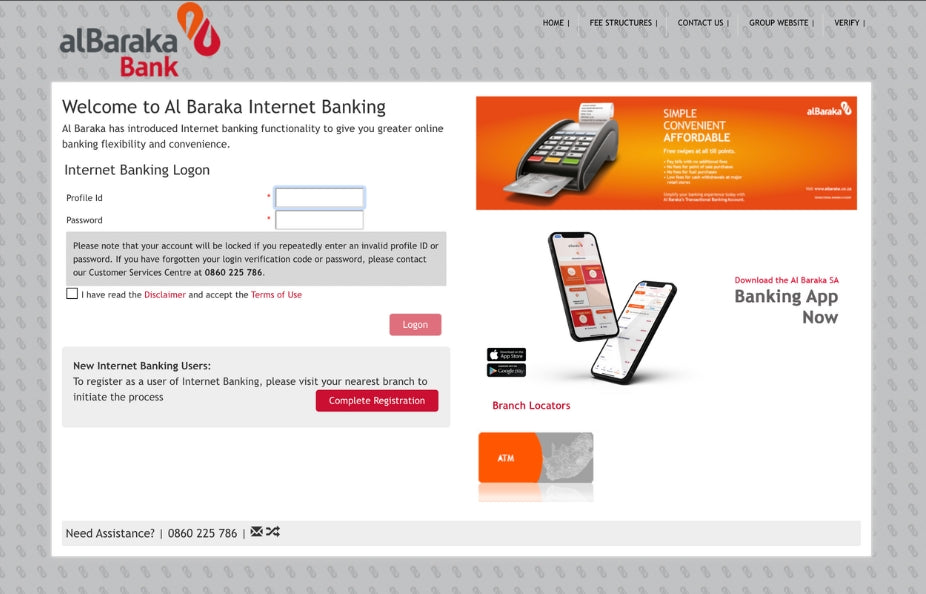

- The inability to access bank accounts or funds belonging to the company;

- The inability to pay salaries, taxes, debts, or other obligations owed by the company;

- The loss of customers, suppliers, partners, or employees due to uncertainty or lack of communication;

- The exposure to legal risks or liabilities due to non-compliance with laws or regulations applicable to the company.

These effects can jeopardise the survival and profitability of the company and may result in its liquidation or deregistration.

How to prevent or mitigate these risks

There are several ways that a sole shareholder and sole director can prevent or mitigate these risks before they die. Some of these ways are:

- Having a valid Will that specifies who will inherit their shares in the company and who will be appointed as their executor.

- Having an agreement with their executor that grants them access to and control over their shares and assets in the company until they are transferred to their heirs.

- Appointing an alternative director.

Case study

Mr X was a well-established young businessman and a sole Director to his business. Mr X tragically passed away. Although Mr X had a Last Will and Testament in place, the Will only dealt with his estate in his personal capacity. His business was a separate legal entity having its own founding documentation to regulate certain eventualities.

Mr X didn’t forsee the need to have further Directors appointed to the business or to cater for succession planning upon his demise. He had a large, successful, thriving business with dedicated staff that relied on the business for salaries to be paid. Mr X died a few days before month end and staff and service providers were expected to be paid. With the family still grieving from the shock of his passing, looking into the needs of the Business was the last thing on their mind.

What happened to the Business upon the Directors Death?

The business effectively came to a halt, no decisions could be made. The business bank account was frozen as the deceased was also the sole authorised person for Banking and his untimely death meant that no other person could do banking and attend to payment of staff salaries and other expenses until a further Director was appointed.

Outcome of the case study

Luckily in this case study, the deceased had a Will and he was not the sole Shareholder. The remaining Shareholder had the ability to appoint a Director which was done by way of a Resolution. The family acted promptly in reporting the estate at the Master of the High Court in order for an Executor to be appointed. This allowed the business to continue once the new Director and Executor for the deceased was appointed.

Learnings

It is critical to plan ahead when you are in a business as a sole Director /Member. If your founding documentation lacks suitable provisions to dictate what is to happen upon the death of a Director/Member, business operations effectively come to a halt, impacting and prejudicing the business and its workers.

Taking proactive steps now during your lifetime to appoint additional persons to your company/business, whether it is your spouse, child or any other person that you deem appropriate, these proactive steps can assist in ensuring that further persons will be available to make decisions to ensure business continuity.

Should you have any uncertainties regarding what is contained your founding documentation or you wish to amend your founding documentation to cater for succession planning on your demise, it is best that you consult with a Legal Practitioner.