DEATH OF SOLE DIRECTORS: THE LEGAL CONSEQUENCES

Eleanore Hiralall| Legal Advisor/Legal Services Division

Dealing with the death of a loved one is an emotionally taxing experience, compounded by the sudden halt of a business they managed. This scenario presents a myriad of challenges, particularly when the deceased was the sole director. Families are often unprepared for the immediate need to address business operations, employee concerns, and service provider issues. The reliance on the deceased for household funds mirrors the dependency of employees and providers on the business, creating a ripple effect of financial strain and operational paralysis.

Dealing with the death of a loved one is an emotionally taxing experience, compounded by the sudden halt of a business they managed. This scenario presents a myriad of challenges, particularly when the deceased was the sole director. Families are often unprepared for the immediate need to address business operations, employee concerns, and service provider issues. The reliance on the deceased for household funds mirrors the dependency of employees and providers on the business, creating a ripple effect of financial strain and operational paralysis.Can a Business continue in the absence of the Sole Director?

If a juristic entity comprises of a sole Director and should the sole Director pass away, the legal consequence of death of that Director means that the Business cannot continue as normal, and the Business becomes incapacitated. What this means is that business operations are frozen until a further Director or Executor for the deceased is appointed.

What happens to employees and service providers during the time in which the Business is incapacitated?

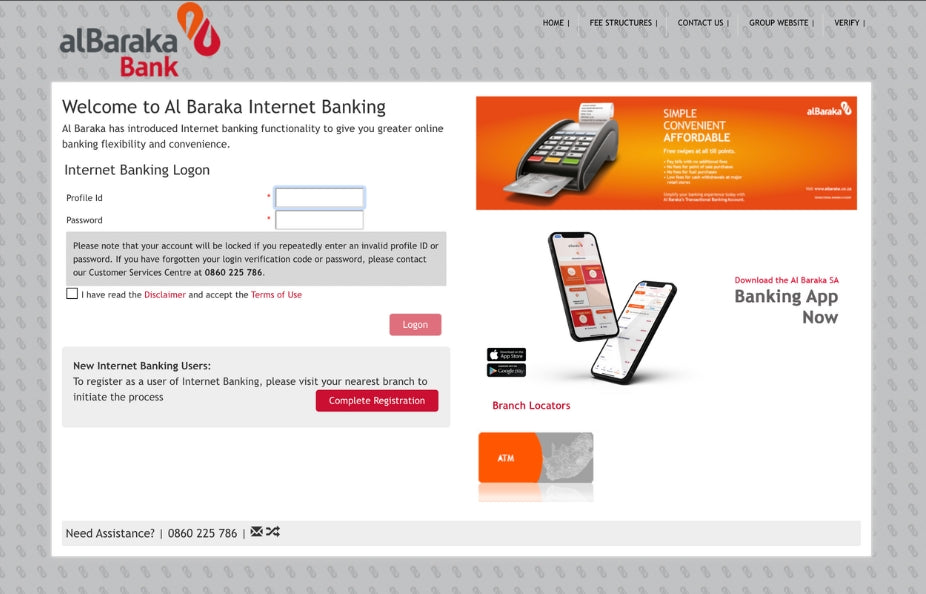

Unfortunately, the legal consequence of death in sole Directorship run businesses means that employees will not be paid as the bank account of the business is frozen and inaccessible. The similar applies to any service providers that provide services to the Business, they too will not be paid.

Ultimately the employees of the business will be prejudiced and would have to suffer undue financial hardship until the business can operate again. Hard working and loyal employees may even be forced to find alternative employment to support themselves and their families.

Additionally, the brand that took years to build will become compromised as the business will soon lose its customer base, forcing the business to possibly liquidate as unpaid expenses, debts, and taxes continue to escalate.

How long would it take to get another Director appointed?

There is no firm answer for this as the appointment of another Director has its own complications and complexities especially if the deceased Director did not have a Will in place and there are disagreements by the deceased’s family, which could take several weeks or months to resolve which means that the appointment of a replacement Director would also be impacted during this period.

Are there any precautionary steps to take during one’s lifetime to avoid a situation where one’s Business becomes incapacitated upon death?

It is always recommended to plan ahead by having contingencies in place, whether in your personal life or in business. When establishing a business for the first time identify suitable persons to fulfill the role of Director to replace you upon death and regulate this in your founding documentation to avoid disputes.

Another critical step to take is to have a Will in place. You can plan ahead by nominating an Executor of your choice who can deal with issues relating to the business such as making decisions on the appointment of an alternative or replacement Director and decisions about settlement of debts until a Director is appointed. It is also important to note that your nominated Executor can only act once formally appointed by the Master of the High Court.

If you already have an established Business, would it be too late to update your founding documentation?

It is never too late to update the founding documentation for your business during your lifetime. Remember, during your lifetime you have full control to reconsider matters and make appropriate changes you feel comfortable with. From a practical perspective, this will require an amendment to be made and filed with the relevant bodies such as the Companies and Intellectual Property Commission (“CIPC”).

The death of a sole director can bring a business to a standstill, affecting employees, service providers, and the overall continuity of operations. However, proactive planning can mitigate these risks. By identifying potential successors, updating founding documents, and having a will in place, business owners can ensure smoother transitions and safeguard their enterprises against unforeseen disruptions. Taking these steps not only protects the business but also honors the legacy of the deceased, providing stability and continuity for all stakeholders involved.

Should you have any uncertainties regarding what is contained your founding documentation, or you wish to amend your founding documentation to cater for succession planning on your demise, it is best that you consult with a Legal Practitioner.