Al Baraka Bank’s Supermarket Link Makes Transactions More Convenient For Clients

26 April 2022

With today’s frenetic pace of life, South Africans are increasingly demanding more convenient and safer banking transaction options, resulting in a dramatic shift in the country’s financial environment.

Al Baraka Bank’s Senior Manager: Electronic and Transactional Banking Division, Mrs Aasiya Jamal, said: “Customer changes in behaviour and interest in electronic payments and transactions has shown a sharp upward trajectory, especially since the onset of the COVID-19 pandemic and resultant Government restrictions.”

“Today, time is a critical factor for many. Because of the demands on our time, more and more people are accessing and using technology, radically altering the way South Africans go about their daily life. Technology is key and Al Baraka Bank has fully embraced the 4th industrial revolution, applying technological advances to bring to our clients’ greater levels of safety and convenience to the financial services they demand,” she added.

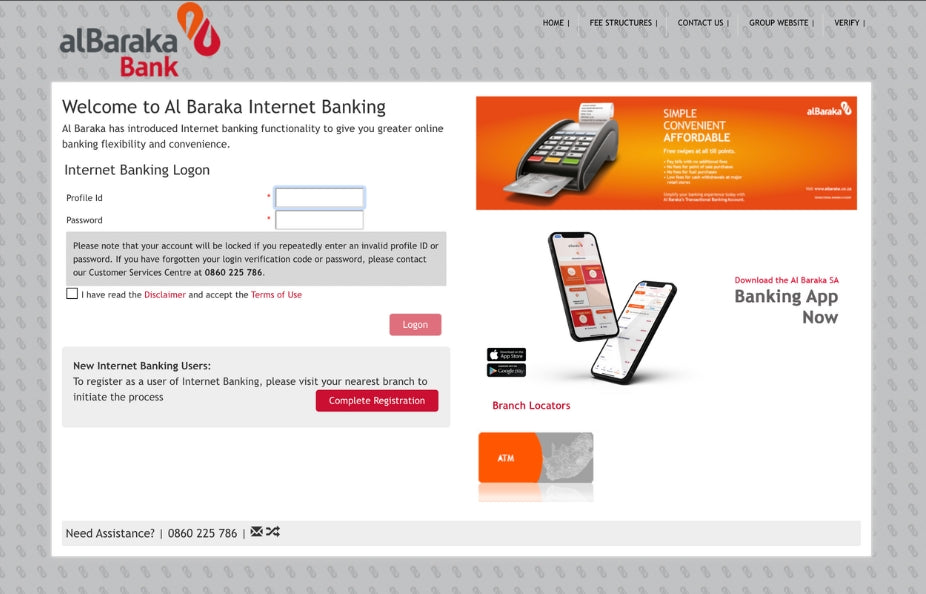

Although the Bank has ATMs in place around the country, Mrs Jamal said that for the additional safety and convenience of clients, both withdrawals and deposits were also possible at major supermarkets.

“Being associated with major supermarket chains, including Checkers, Shoprite, Usave, Pick ‘n Pay and Boxer, for transactional banking purposes is not only convenient to clients, but – in effect – significantly expands our Bank’s national footprint.”

She said: “Withdrawals at till points are based on an individual’s card limit, to a maximum of R5 000, and also depend on the store’s in-house rules. Some stores may reduce this amount due to cash intake at particular stores. Of course, it is also possible for our clients to deposit up to R3 000 directly into their transactional banking accounts utilising till points at Checkers, Shoprite and Usave stores, and to a maximum of R5 000 at Pick 'n Pay and Boxer outlets, whilst paying for their shopping. Critically, deposits made at retail till-points anywhere in the country reflect immediately in the client's account.”

Shoppers wanting to undertake in-store banking transactions are not required to queue separately to benefit from the service. Although Al Baraka Bank does not charge any fees for such deposits, a fee of R19-95 is charged up-front per transaction, irrespective of the amount deposited.

Mrs Jamal said that the Bank’s clients were able to also deposit funds by utilising any of its fully-fledged branches, as well as via an estimated 600 ABSA branches and ATMs. Cash withdrawals may be performed at any bank ATM, making it convenient for clients without access to Al Baraka Bank ATMs to transact.

“Supermarket transaction facilities exist at 1 700 Pick 'n Pay and Boxer stores and 1 200 participating Checkers, Shoprite and Usave outlets across the country. Our primary objective is to continuously evolve our services to clients. We regard the convenience of transacting in the banking experience as a top priority," she said.

The Bank has also announced the recent introduction of its Mobile Banking App, providing convenience and safety for clients wishing to conduct their daily transactions on mobile devices. Another exciting development set for the near future includes a web portal for client applications for motor vehicles and residential properties, which will be added to the Bank’s website soon.